1. Research Question

What are the challenges in the industrialization of additive manufacturing? Can IT products be developed to overcome those challenges?

2. What is Additive Manufacturing

Additive manufacturing (AM) or 3D printing is the manufacturing of a three-dimensional object. The object is first designed and simulated as a digital 3D model in CAD software and then printed in a printer. This printing is done in a variety of processes in which material is either deposited, joined or solidified, typically layer by layer, under computer control. Also, there are a variety of materials used to build objects such as plastics, liquids or metal powder grains. 3D printing is the most common term in the consumer markets, while AM is mostly used in the industrial markets. Though, the advent of 3D printing has revolutionized the manufacturing industry in many ways and the technology has infiltrated almost every workshop across the world, it is still the case that casting, fabrication, stamping, and machining are more prevalent than additive manufacturing. Since the AM technology is still in its nascent stage as compared to conventional manufacturing methods, it is marred with challenges which bars the adoption of the technology for full volume applications and is limited to prototype building.

3. AM Ecosystem

The additive manufacturing ecosystem is a complex interconnected network of entities involved in the AM process. This ecosystem is made up of several key components:

- Hardware: This includes the 3D printers themselves, which use various technologies such as stereolithography and selective laser sintering.

- Software: Software tools, such as CAD and slicing software, are integral to the 3D printing process. They help with designing the model and preparing it for printing.

- Materials: A variety of materials like polymers, metals, ceramics, etc., are used in additive manufacturing.

- Post-processing Systems: These systems are used after the printing process for finishing the printed parts.

- Research Institutions: Institutes of national importance such as IITs, NITs, RRCAT, ISRO, BARC, and others have shown significant progress in R&D and contribute significantly to the development of new technologies and startups in the field of additive manufacturing. The ecosystem is also supported by government initiatives, technological advancements, and interest from various industries.

Key Players in Additive Manufacturing: The additive manufacturing ecosystem includes numerous key players, ranging from companies providing hardware, software, and materials to those offering specialized services. These companies are driving innovation and growth in the additive manufacturing industry. Please note that this is not an exhaustive list and there are many other players in each component of the AM ecosystem. The key players listed here are some of the prominent ones in their respective fields.

| Component | Key Players |

|---|---|

| R&D Centres & Institutes | National Centre for Additive Manufacturing (NCAM), Central Manufacturing Technology Institute (CMTI) |

| Material Providers | BASF, DSM Somos, Stratasys, 3D Systems, EOS |

| Software Providers | Siemens, Hexagon, Oqton, Stratasys, Bluestreak, Infor CloudSuite Industrial, MaterialCenter, E2 Shop System, Materialise Streamics, Autodesk |

| Hardware Providers | Stratasys, 3D Systems, EOS, HP, Formlabs, Carbon, Creality, Materialise |

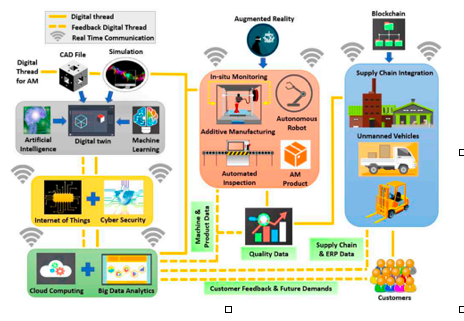

Figure 1: AM Ecosystem

4. Types of Additive Manufacturing

There are many kinds of additive manufacturing technologies used today based on the following factors: i. the way layers are deposited to create parts. ii. the type of materials used. Each process has its own advantages and drawbacks hence the main considerations in choosing an AM process are generally specific application and requirements, speed and costs of the 3D printer, cost of the printed prototype and of the materials, and color capabilities. Some of the most common AM processes include:

| AM Process | Method | Technology |

|---|---|---|

| Sheet Lamination | This method uses sheets of material (metal orplastics) that are bonded together layer by layer using welding or adhesive. The desired shape is cut by a laser or blade. | Laminated Object Manufacturing (LOM), Ultrasonic Additive Manufacturing (UAM) |

| Extrusion Deposition | This technology uses a thermoplastic polymer such as ABS, PLA, PETG, and PEI, in the form of filament, that is melted and extruded through a nozzle to create a 3D object layer by layer. The nozzle moves in a path or X-Y plane, defined by the CAD model | Fused deposition modeling (FDM), Plastic Jet Printing (PJP) |

| Granular Materials Binding | This technology uses a laser or dropping glue to selectively sinter powdered material, layer by layer, into a solid object. | Selective Laser Sintering (SLS), Selective Laser Melting (SLM), Electronic Beam Melting (EBM), Binder Jetting |

| Light Polymerisation | This technology uses UV light to cure a liquid plastic or resin into a solid object layer by layer, through a curing process. It uses a photosensitive thermoset polymer that comes in liquid form. | Stereolithography (SLA), Digital Light Processing, (DLP), Polyjet Printing (PJP), Film Transfer Imaging |

5. Applications

Industrial Use Cases: i. Medical Industry: In November 2021 a British patient named Steve Verze received the world's first fully 3D-printed prosthetic eye from the Moorfield's Eye Hospital in London. ii. Aerospace Industry: One example of AM integration with aerospace was in 2016 when GE (General Electric) started integrating 3D printed fuel nozzles into its LEAP engines, reducing parts from 20 to 1, a 25% weight reduction, and reduced assembly times. Similarly, in 2015, PW (Pratt and Whitney) delivered their first AM parts in the PurePower PW1500G to Bombardier. Sticking to low-stress, non-rotating parts, PW selected the compressor stators and synch ring brackets to roll out this new manufacturing technology for the first time.

6. Challenges for the Industrialization of AM

- Size limitations: The current inability to manufacture large and odd-sized parts is one of the biggest challenges of additive manufacturing. According to Deloitte, additive manufacturing especially underperforms, compared to traditional manufacturing, when it comes to the production of certain large aircraft components. Several AM providers and research institutes are already working on addressing this challenge, among these, UK company BAE systems, who used AM to manufacture a 1.2-meter titanium wingspear in collaboration with Cranfield University.

- Workforce Shortage: Another challenge is the technical expertise required to manage and operate the equipment. That expertise may have to be developed internally with outside training, which is a slow process when attempting to justify capital equipment. File conversions and equipment expertise are only a portion of the labor requirements. Depending upon the technology, an operator may need to be on hand to swap filaments mid-print, adjust the settings, remove any support structures, and perform any post-processing operations.

- Slow Production Speeds: 3D printing is known for slower manufacturing speeds, preventing the technology from high-scale production applications. Equipment manufacturers understand this shortcoming and are diligently looking at methods to improve production speeds. Selective Laser Sintering (SLS) printers have adopted two print heads to sinter powder faster. Other printer prototypes can reportedly print thirty layers simultaneously rather than one.

- Post Processing Tasks: Most 3D printed parts require some form of post-processing to achieve the desired technical attributes and finish. While AM allows for complex designs, the post-processing of parts requires additional labor which makes it time–consuming and contributes to overhead costs per unit. Few examples of the most common post-processing tasks include support removal, resin removal, sanding, polishing and painting, vapor smoothing and curing. The challenge is to automate these operations with robotics and automated material handling systems. Though there has been a little technological development from companies like PostProcess which use SVC technology, based on principles of heat & fluid flow, for support and resin removal, there is a long way to achieve automation of all the post-processing tasks. Further, design for additive manufacturing (DFAM) is a useful tool in reducing the amount of post-processing needed for additively manufactured parts.

- Software: There are limited capabilities in data preparation and design as an array of software is required, like CAD, Slicers, file conversion software. This raises the need for all-encompassing software which can provide all the digital capabilities from design to workflow management. The result is that the industry has been developing workflow management software specifically for 3D printing. This software aids in managing the workflow, including requests, printability analysis, machine analytics, production scheduling, post-processing management, and supplier communication.

- Quality: Additive manufacturing faces certain challenges with quality consistency, especially in producing fully dense metal parts where the part-to-part variation, non-uniform strength in the plane of layers, and contamination of material are major concerns. Some of this is material related, while improper storage and handling is another aspect. Standardized testing is needed to ensure material and handling quality. Since, inline quality control is still relatively new to AM technologies, the ability to monitor the build in real-time with cameras and sensors embedded inside a 3D printer will allow the shift from an open-loop to a closed-loop control system which will contribute to consistent geometries, material properties, and surface finishes of superior quality.

- Narrow range of materials: Currently, additive manufacturing technology generally uses a small group of polymers and metal powders to produce parts. These are costly materials with much higher price tags than the materials used in traditional manufacturing, lowering the incentives to use additive manufacturing in production. Moreover, there is a lack of standardization and suitable quality (mechanical and thermal properties) of materials. This issue must be solved with advances in materials science, expanding materials selection and thus lowering costs. While there has been significant progress in developing new materials, some industries require specific properties that are still challenging to replicate with AM. Not all metals and plastics can be temperature- controlled enough for the conditions that AM requires. Most polymers used in AM cannot be recycled and those that can be suffer a potential quality loss.

- Intellectual Property Concerns: As AM becomes more accessible, concerns about intellectual property theft and the potential for counterfeiting have grown. Pressing issues include protecting digital design files and enforcing intellectual property rights.

7. Integration of AM with Digital Technologies

7.1 Use Cases

This section aims to explore the transformative potential of the convergence of Additive Manufacturing (AM) with advanced digital technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), Robotics, and Augmented Reality (AR). The integration of AM with these technologies is ushering in a new era of manufacturing, characterized by increased efficiency, customization, and innovation. The benefits of this convergence are manifold. It enables real-time monitoring and optimization of the manufacturing processes and equipment through IoT and AI, leading to improved quality and reduced waste. Robotics enhances precision and repeatability, while AR provides immersive and interactive experiences for design and training purposes. Together, these technologies are revolutionizing the manufacturing landscape, paving the way for Industry 5.0. This section will delve into various use cases that highlight the immense value and opportunities brought about by this technological convergence.

| Digital Technology Used | Use Case | Value |

|---|---|---|

| AI based Generative Design | Airbus, using The Living, an Autodesk Studio, manufactured a ‘bionic partition’ to separate the passenger cabin from the galley. The innovative design mimics the organic cellular structure and bone growth found in living organisms. | A partition that is structurally very strong but also lightweight, weighing 45% (30 kg) less than current designs which means less fuel consumption. When applied to the entire cabin and to the current backlog of A320 planes, Airbus estimates that the new design approach could save up to 465,000 metric tonnes of CO2 emissions per year. |

| Internet of Things | Airbus leveraged AM and IoT for spare parts replacement. They placed IoT sensors to monitor cabin components, brackets, and other non-critical parts during flight. When wear or damage was detected, the system automatically 3D printed the replacement parts. Further, IoT sensors are also used to monitor energy consumption in AM machines and guide the operators to adjust parameters to optimize energy usage. | “Thus, AM allowed on-demand production of spare parts, reducing downtime and inventory costs while ensuring timely replacements. It also contributes to sustainability and more cost savings through energy optimization. |

| Robotics | “Airbus can manufacture and assemble objects in space using 3D printing and in-orbit robots. Their team’s work covers three main areas. The first is manufacturing via 3D printers, which can use metal, and later regolith (Moon dust), or recycle manmade objects already in space as source material to print new parts. The second area is in-space assembly, which can be used to create very large structures like antennas. This requires a high level of robotic operation, which is the third area. Remote monitoring and control of in-orbit robotic operations will be achieved with virtual reality and visual serving for motion control. Meanwhile the ISMA team is developing its own modular robotic arm and tools with the high level of accuracy required for such operations. The aim is to test this by placing a robotic facility on the ISS’s Airbus-built Bartolomeo payload hosting platform by the mid-2020s, forming a “digital factory” in space. | Manufacturing and assembling objects in space has significant advantages over producing everything on Earth and subsequently transporting them to space. For example, objects manufactured/assembled in space are not constrained by the size of a launch vehicle, nor must they be “over-designed” to withstand rigorous launch conditions. |

| Augmented Reality | The field of medicine and health care showed a workflow for developing 3D printed and AR kidney models using radiology examination and image segmentation. The radiological data was used to create a 3D model of the kidney using multicolor PolyJet technology (Stratasys J750), allowing a transparent kidney with the coloring of the renal tumor, artery, vein, and ureter. An AR kidney model was created using Unity 3D software and deployed to Microsoft HoloLens. The 3D printed and AR models were used preoperatively and intraoperatively to assist in robotic partial nephrectomy. | Pre-operative three-dimensional (3D) printing and augmented reality (AR) models allow surgeons to better assess the relationship of the tumor to major anatomical structures such as the renal vasculature and hilum. This facilitates surgical planning, anatomical understanding and better decision making during robotic partial nephrectomy. |

7.2 Digital Thread

Considering the extensive review in Section 7.1 discussing the use of Industry 4.0 pillars for and with AM, it is evident that the integration of AM and other pillars of Industry 4.0 can lead to the establishment of, what can be called as- “factories of future”. Kim et al. [25] proposed a digital thread for metal AM processes that enables the verification and validation of AM information across the digital spectrum and can help in efficient and consistent design-to-product transformations. The ability to manage AM data across its lifecycle can lead to efficient product development with optimized processes reducing wastage and saving costs. In this context and based on the discussion provided in Section 7.1, a conceptual digital thread for AM integrating the pillars of Industry 4.0 is discussed in this section.

Figure 2: Digital Thread for AM

All the pillars of Industry 4.0 use digital features that require electronic resources to generate, store, or process data. Since AM relies on digitally driven technologies, therefore, the digital thread begins with the AM process. AM can be used to manufacture a product and that requires the generation of a CAD file on a CAD software package (e.g., Autodesk Inventor or SolidWorks) installed on the computer. This CAD file can be used to undertake numerical simulations under different conditions (using ANSYS or ABAQUS) to assess the product’s behavior. This can lead to the development of a digital twin that can be used to analyze the product build or other characteristics. The digital twin can be aided with algorithms for machine learning and artificial intelligence for enhanced performance and realistic results. The AM system could be retrofitted with sensors to transfer data wirelessly over the Internet to the digital twin to improve the process using in-situ monitoring or to enhance the quality of the product being manufactured. The transfer of data over the Internet in a digital format needs to be protected to avoid cyber-attacks that can negatively affect the product being manufactured and could also damage the AM system in operation. The protection of data is also crucial to avoid losing sensitive and confidential information to hackers. These aspects show the importance of cyber security. The generation of data, processing, and digital transfer comprises the main characteristics of Industry 4.0. This also means that there are copious amounts of data that require processing and transfer to the appropriate channels. The use of big data analytics with artificial intelligence and machine learning protocols can help to significantly improve the quality of AM products with the use of digital twins that can accurately predict issues through simulations. Analyzing large data sets requires the use of expensive and sophisticated hardware that can run simulation programs easily. This can be remedied by cloud computing that offers a subscription-based model and can be used for various AM-related tasks e.g., manufacturing, knowledge management, decision support system, and order processing. With the digital data being transferred among AM processes, other elements of Industry 4.0 can also support AM through the digital thread. For example, AR can be used for comparing an augmented version of the product to be manufactured with the physical product during the build to identify defects. The use of AR markers and augmented interfaces for print visualization are useful tools. Cobots (or collaborative robots) are also becoming popular as they offer ease of automation and can be used for manufacturing, coordination, data management, remote access, and control. Autonomous robots have been widely associated with AM as the use of robotic arms for large scale manufacture is gaining attention from academia and industries alike. These systems can manufacture large structures using different materials. Combining these elements into the horizontal/vertical integration can offer substantial benefits in developing organization-wide protocols for data sharing to create the basis for an automated supply and value chain resulting in real-time control of the product life cycle. The conceptual digital thread binds together the pillars of Industry 4.0 to provide better data discovery, data mining, and modelling, to drive the material, process, and geometry optimization leading to significant cost savings and complete digital transformation of an organization.

8. Cost-Benefit Analysis of Adopting AM

In the realm of Additive Manufacturing, a comprehensive Cost-Benefit Analysis is pivotal to understanding the economic feasibility and potential profitability of this technology. This section delves into the intricate details of the cost analysis criteria, providing a thorough examination of the major cost factors that influence the overall expenditure in additive manufacturing. These factors include machine costs, material costs, labor costs, and post-processing costs. Each element plays a significant role in the total cost structure and directly impacts the cost-effectiveness of additive manufacturing processes. By dissecting these costs, we aim to provide a clear picture of the financial implications of adopting additive manufacturing, thereby enabling informed decision-making for businesses considering this technology. There are two major motivational categories for examining additive manufacturing costs. The first is to compare additive manufacturing processes to other traditional processes such as injection molding and machining. These examinations determine under what circumstances additive manufacturing is cost-effective. The second category involves identifying resource use at various steps in the additive manufacturing process. The purpose of this type of analysis is to identify when and where resources are being consumed and whether there can be a reduction in resource use.

8.1 Cost Analysis Criteria

According to the cost analysis, done by NIST (National Institute of Standards and Technology), the research presents data for a sample part made of stainless steel. The production quantity is a little less than 200 for the base case. The base model has a build rate of 6.3 cubic centimeter/hr., a utilization of 4500 h/yr., a material cost of $96.32, and a machine investment cost of $541 000. This research on the metal part provides insight into identifying the largest costs of additive manufacturing and confirms that machine and material costs are a major cost driver for this technology followed by many others.

8.2 Cost Factors

The major cost factors that influence the overall expenditure in additive manufacturing include machine costs, material costs and post-processing costs. Each element plays a significant role in the total cost structure and directly impacts the cost-effectiveness of additive manufacturing processes. Other, but less direct cost factors include labor costs, type of AM technology, envelope size, envelope utilization, product design, build orientation, production volume and many more.

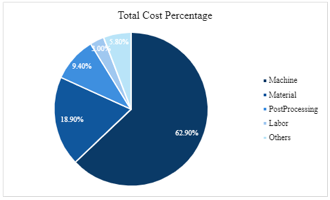

- Machine Cost: Machine cost is one of the most significant costs involved in additive manufacturing. The machine investment costs also include items related to housing, using, and maintaining the additive manufacturing system. The average selling price of an industrial additive manufacturing system is upwards of $100,000. While the trends in machine costs are generally downward, the cost difference between the different types of additive manufacturing machinery is quite significant ranging between $0.1 million typically for polymer systems and $1.0 million typically for metal systems. Given the tremendous growth in sales of low-cost, polymer-based systems during this time has strongly influenced the average selling price of additive manufacturing systems. On average, machine costs account for 62.9 % of the manufacturing cost.

- Material Cost: The second largest cost in the fabrication of a metal part is the materials, which, on average, account for 18.9 % of the manufacturing costs; however, it is important to note that this cost is likely to decrease as more suppliers enter the field.

- Post Processing Cost: According to the National Institute of Standards and Technology (NIST), post-processing costs account for 4 to 13% of overall production costs depending on the exact process and materials involved like: internal stresses in the fabricated metal part must be relieved before the part is removed from the build plate which can typically cost $500 to $600, plus shipping. In another example most companies spend about $200 to $300 per plate to remove parts from the build plate using wire EDM or bandsaw. Further, heat treatment can easily cost $500 to $2,000 depending on the material and how many parts are being treated.

- Labor Cost: As illustrated in Figure below, labor tends to be a small portion, not more than 3% of the additive manufacturing cost. Labor might include configuring the AM system, monitoring the build, removing the finished product or refilling the raw material among other things.

- Energy Cost: Energy consumption is an important factor in considering the cost of additive manufacturing even though it contributes less than 1% to the final cost. Energy studies on additive manufacturing, however, tend to focus only on the energy used in material refining and by the additive manufacturing system itself.

Figure3: Cost Structure for AM system

8.3 Correlation among Cost Factors

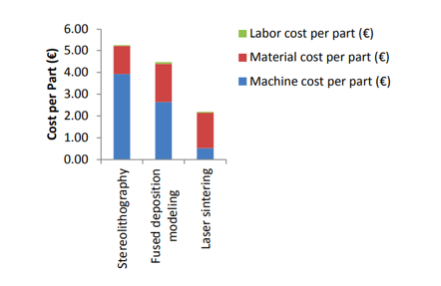

- Varying AM Technology: NIST investigates the additive manufacturing costs of a polymer part (a lever), using different AM technologies like stereolithography, fused deposition modeling, and laser sintering. A cost breakout for the lever is provided in Figure 3.5. The material cost represented 25 % of the cost for stereolithography, 39 % for fused deposition modeling, and 74 % for laser sintering.

Figure4: Cost Comparison by varying AM Technology

- Varying Build Rate: Building rate is the speed at which the additive manufacturing system operates i.e. the amount of the part manufactured in a unit of time. It is measured in cubic centimeters per hour. The build rate directly impacts the – material costs and energy costs. A high build rate means more material and energy required to operate hence these costs increase proportionately.

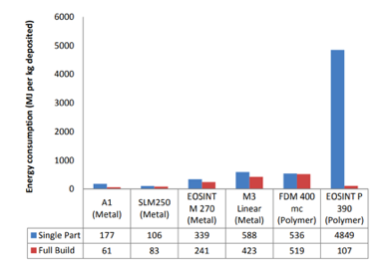

- Varying Build Size: The size of the build envelope has an impact on the cost of an additive manufactured product. The size of the build envelope has two impacts. First, products can only be built to the size of the build envelope, which means that it might not be possible to build some products using additive manufacturing technologies without enlarging the build envelope. The second impact of the build envelope is related to utilizing the total amount of build capacity. A significant efficiency factor lies in the ability to exhaust the available build space. For example, Baumers et al. (2011) examined the impact of capacity utilization on energy using six different machines (Arcam - A1, MTT Group - SLM 250, EOS GmbH - EOSINT M 270, Concept Laser GmbH - M3 Linear, Stratasys Inc - FDM 400 mc, and EOS GmbH - EOSINT P390) and four different materials (titanium, stainless steel, and two kinds of polymers). As seen in the figure below, the full build case, where the build envelope is fully utilized, uses less energy per kilogram deposited than one single part being produced for all six different machines. The EOSINT P 390 has the largest build volume and has the largest difference in energy consumption between a single part and full build.

Figure 5: Energy Cost Comparison by varying Build Size

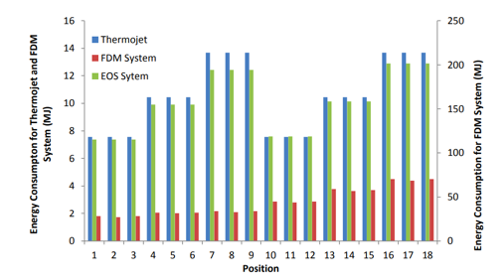

- Varying Build Orientation: Envelope utilization and build orientation are among the issues for reducing energy consumption. NIST examines the impact of part orientation for three systems: Stratasys FDM 3000, 3D Systems Thermojet, and EOS EOSINT M250 Xtended.42 They examined 18 positions for a single part. Due to the change in the position of the part, the energy consumed could increase between 75 % and 160 % depending on the system, as illustrated in the figure below. This figure also illustrates that the position for one system may have low energy consumption, but for another system it might not have a low consumption.

Figure 6: Energy Cost Comparison by varying Build Orientation

8.4 Cost Comparison between AM & Traditional Manufacturing (TM)

- Material Costs: As discussed previously, metal and plastic are the primary materials used for this technology. Currently, the cost of material for additive manufacturing can be quite high when compared to traditional manufacturing. For example: In traditional manufacturing a water bottle can be fabricated from PET (Polyethylene Terephthalate) material which roughly costs $1.3/kg whereas in additive manufacturing PET is replaced by PETG, the ‘G’ refers to glycol, which is partially replaced with cyclohexanedimethanol (CHDM) to create a material more suitable for 3D printing. A decent quality PETG filament costs around $20 to $30 per kg and higher-end materials like MatterHackers Pro Series PETG cost close to $60/kg. Similarly, the material costs for a metal part made from selected laser melting is upwards of $500 per kg of these special metallic powders, whereas regular stainless steel can be found for prices ranging from $90 to $120 per kg. Thus, the additive manufacturing material is more than five times more expensive.

- Inventory Costs: At the beginning of 2011, there were $537 billion in inventories in the manufacturing industry, which was equal to 10 % of that year’s revenue. This inventory is tied up capital and the resources spent producing and storing these products could have been used elsewhere. Suppliers often suffer from high inventory and distribution costs. Additive manufacturing provides the ability to manufacture parts on demand. For example, in the spare parts industry, a specific type of part is infrequently ordered; however, when one is ordered, it is needed quite rapidly. Traditional production technologies make it too costly and require too much time to produce parts on demand. The result is a significant amount of inventory of infrequently ordered parts. They occupy physical space, buildings, and land which require rent, utility costs, insurance, and taxes. Meanwhile the products are deteriorating and becoming obsolete. Being able to produce these parts on demand using additive manufacturing reduces the need for maintaining large inventory and eliminates the associated costs.

- Transportation Costs: Traditional manufacturing often includes production of parts at multiple locations, where an inventory of each part might be stored. The parts are then shipped to a facility where they are assembled into a product. Alternatively, additive manufacturing allows to produce multiple parts simultaneously in the same build, making it possible to produce an entire product without requiring the need of assembly. This reduces the need for transportation and just-in-time delivery of parts produced at varying locations, as this process might allow for the entire assembly’s production. Because of this feature, three alternatives are possible for the diffusion of additive manufacturing.

- The first is where a significant proportion of consumers purchase additive manufacturing systems or 3D printers and produce products themselves.

- The second is a copy shop scenario, where individuals submit their designs to a service provider that produces goods.

- The third scenario where additive manufacturing might allow some of these parts or products to be produced near the point of use or even onsite. This would be possible where there is limited exposure to hazardous conditions, and there is little hazardous waste. Further, localized production combined with simplified processes may begin to blur the line between manufacturers, wholesalers, and retailers as each could potentially produce products in their facilities resulting in a distributed manufacturing system

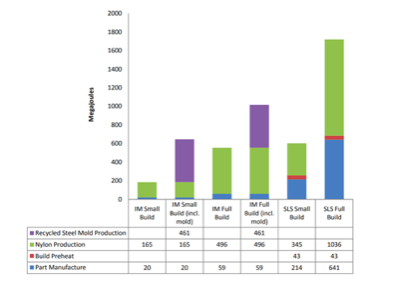

- Energy Costs: Telenko and Seepersad (2012) examined energy consumed in the production of nylon parts using selective laser sintering and compared these results to that of injection molding. This analysis included a small build of 50 parts and a full build of 150 parts. The results are shown in Figure 3.9 with injection mold values (IM) shown both with the energy consumed for the mold’s production and without it. A significant portion of the cost for injection molding is the mold itself. As seen in the figure, the small build for selective laser sintering used less energy than the small build for injection molding (including the energy for the mold). However, the energy for the full build was approximately 69 % higher. For the full build, approximately 60 % of the energy was used in nylon production and 37 % was used in part manufacture for selective laser sintering. They identified the components that are major consumers of energy: chamber heaters (37 %), stepper motors for piston control (26 %), roller drives (16 %), and the laser (16 %).

Figure 7: Energy Cost Comparison between TM & AM

9. Impact of AM on Manufacturing Processes

| Manufacturing Process | Impact/Benefits of AM |

|---|---|

| Product Design & Development | AM can make lighter yet stronger parts with minimal wastage of resources. Designers can fabricate products with complex structures and geometry. |

| Staffing | Organizations must recruit new hires or train existing staff to work as AM machine operators, procurement staff and staff for post processing tasks. Training for AM includes courses that cover essential skills in 3D printing technologies, materials science, and design principles. |

| Controlling | Organization must invest and implement other Industry 4.0 technologies like IoT and digital twins for monitoring and controlling the AM toolset and processes. Robotics can be used to correct the work performance. |

| Quality Assurance | An additional set of AM-related quality standards must be followed. These standards will define terminology, measure the performance of different production processes, guarantee qualification of operators, ensure the quality of the end products, and specify procedures for the calibration of additive manufacturing machines. Some of the international quality standards to follow are ISO - 25.030, ASTM International |

| Procurement | “Companies would need to choose suppliers based on their AM capabilities so new procurement policies must be implemented. Higher material cost but less quantity of material required compared to traditional manufacturing. New competitors are also entering the OEM market. Large players such as Stratasys and 3D Systems are producing medical parts with newly developed materials, using their own printing technology and offering printing services to customers such as hospitals, which formerly purchased from OEMs. |

| Sales & Marketing | Companies can charge premium pricing and acquire new customers by offering a superior and/or new product manufactured by AM technology. The innovative products can also act as a differentiator for them. |

| Inventory Management | On one hand, special material storing and handling systems must be built to handle AM materials in the form of fine metal powder, resin liquid or plastic filaments, etc. and contrary it also allows for on-demand production, reducing the need for inventory and the risk of obsolescence of manufactured products and spare parts. |

| Supply Chain Management | AM simplifies or shortens the supply chain by removing many intermediate steps which leads to cost savings and faster time to market. It also reduces the vulnerability to disasters and disruptions. A smaller supply chain with fewer links means there are fewer points for potential disruption. Provides decentralized manufacturing opportunities where manufacturers can co-produce with suppliers, distributors, retailers and customers on the point of use. |

| Spare Parts Management | On-demand and On-location manufacturing with reduced inventories. |

10. Market Analysis

10.1 Market Definition

This market analysis on additive manufacturing takes into consideration the following statement as the market definition: “Additive Manufacturing Market represents all additive hardware, software, materials, processes, technologies, systems, applications and outsourced services including the peripheral market i.e. ancillary equipment used in AM production and service contract revenue from machines sold.”

10.2 Market Value

The below table depicts the present and projected market value of the entire (including all the components of the AM ecosystem) additive manufacturing industry worldwide as surveyed by the esteemed market research companies.

| Market Survey | Present Value in 2024 | Estimated Value in 2029 | CAGR | |

|---|---|---|---|---|

| Forbes | $14.96 bn | $25.24 bn | 15.9% | |

| MarketsandMarkets | $17.5 bn | $37.4 bn | 16.4% | |

| Statista | $20.24 bn | $41.58 bn | 17% | |

| Precedence Research | $24.58 bn | $58.46 bn | 18.92% | |

| Data Bridge | $25.66 bn | $62.24 bn | 19.39% | |

| Fortune Business Insights | $27.52 bn | $68.42 bn | 23.6% |

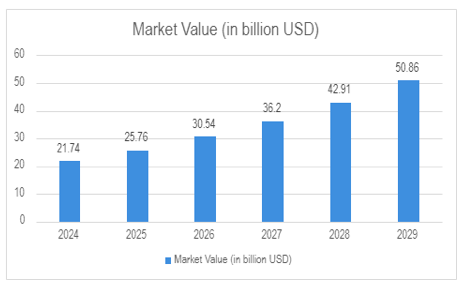

The below chart, as derived from the table above, depicts a robust growth in the AM industry, from market value of $21.74 bn in 2024 (average value calculated from the above table) to becoming a more than 50 billion US dollar industry in next five years, compounding at a CAGR of 18.53% (average value calculated from the above table).

Figure 8: Market Value Forecast for AM

10.3 Market Growth Drivers

Few of the primary growth drivers for the 2029 AM outlook are: Standardization in additive manufacturing at the industry level: Throughout 2021, progress was made in dozens of standards development projects, and in this year alone several key publications -such as the ASTM International F3529 standard for material extrusion -were announced which will pay dividends in terms of growth in the short term. Technological advancements in the existing 3D printing technologies: In Nov 2023, Stratasys introduced the F3300 FDM printer at the Formnext conference, promising new FDM technology producing significant enhancements in speed, throughput, reliability, and quality. Advancements include linear motors and encoders for fast, precise extruder movement, four extruders with a patented automatic tool (extruder) changer for multi-resolution printing and system redundancy, material dryers for optimal material characteristics, and autocalibration to reduce labor and operator input. Four material bays and large 4100 cc (250 cu.in.) spools provide sufficient material capacity for uninterrupted longer build times. Reducing cost of printers: As technology advances and competition increases, the cost of all 3D printers – personal, professional, and industrial - continue to decrease, further boosting market growth. Increasing range of industrial grade 3D-printing materials: 3D printing materials can vary widely, with options that include plastic, powders, resins, metal, and carbon fiber. These materials make 3D printing a promising option for many parts, from highly accurate aerospace and industrial machinery components to construction industry. Examples include 3D printable concrete which is specially formulated for 3D printing applications in the construction industry. It typically consists of cement, aggregates (such as sand and gravel), water, and additives. Another example is the new bionic partition installed in Airbus aircraft, made from Scalmalloy®, a second-generation aluminium-magnesium-scandium alloy created by APWorks, an Airbus subsidiary. Government support in AM technology: Governments recognize the potential of AM technology and offer support through funding, skill development and infrastructure development, fostering a favorable environment for 3D printing. Ministry of Electronics and IT, under Gov. Of India, has come up with a National Strategy for Additive Manufacturing. The aim of this initiative is twofold: to Position India as a global hub for Additive Manufacturing and to create and protect the integrity of India’s AM intellectual properties. In another example, The UK government’s Research and Innovation agency (UKRI) has announced an investment of £14 million, in a scheme known as the Sustainable Smart Factory Competition, into novel projects which promise to harness the AM technology. Photopolymer innovation company Photocentric was granted over £1 million for their scheme, known as Low Energy Autonomous Digital Factory (LEAD). Expiring Patents: Even though AM first appeared in the mid 1980’s, it gained popularity over the last five to ten years especially, owing to the expiration of important patents related to AM. This led to a wave of consumer-oriented printers and finally, a vibrant start-up scene has arisen as most patents on existing AM technologies have run out, leaving space for new (as well as established) players from various industries to enter at all points in the value chain. New design and service companies are being set up and new technologies developed, such as BigRep and Carbon3D.

10.4 Market Segmentation

The analysis covers the demand and supply sides of the 3D printing market. The supply-side market segmentation has been conducted based on components (including printers, software, materials, and services) and technologies. On the other hand, demand-side segmentation includes various verticals and regions. The market research provides comprehensive data, with forecasts from 2024 to 2029, for the following segments:

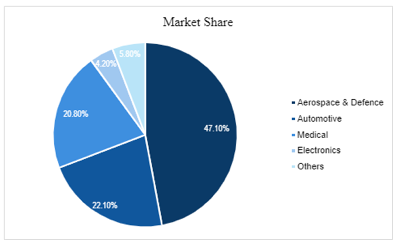

- By Industry Adoption: Most of the market potential will come from the aerospace and defense, automotive, medical, dentistry and construction. Other verticals include space exploration, offshore marine and consumer goods.

Figure 9: Market Share by Industry Adoption

- By Geography: Geographically, the market is divided into five major regions: North America, South America, Europe, Middle East & Africa, and Asia Pacific. North America is expected to dominate additive manufacturing market due to increasing demand for lightweight components from automotive and aerospace industries in the region. The U.S. is expected to dominate the North America market due to pioneering technology, substantial government and private investment, and early adoption across major industries like aerospace and healthcare. India and China are expected to show a steep growth in the Asia-Pacific region due to rapid industrialization, increasing construction activities and growing infrastructure development and manufacturing sectors. Germany is expected to dominate the Europe market due to its strong engineering tradition, significant investments in research and development, and robust manufacturing sector.

- By AM Technology: Based on technologies, additive manufacturing market is segmented into Stereolithography (SLA), Fused Disposition Modelling (FDM), Laser Sintering (LS), binder jetting printing, Polyjet printing, Electron Beam Melting (EBM), Laminated Object Manufacturing (LOM), and others. In the technology segment, Fused Deposition Material to hold the largest market share during the forecast period.

- By AM Components: Hardware: The market for hardware includes both the printers and the post-processing equipment. The revenues are associated with the sale as well as maintenance contracts of these hardware equipment. Software: While a fleet of 3D printers may be capable of manufacturing at volume, that doesn’t mean that they’ll necessarily fit into an existing factory operation. In large part, this is due to the fact that they lack mass production-level software. So, a handful of startups have emerged to take on the challenge of developing AM-specific software for manufacturing execution systems (MES). These tools make it possible to both manage a fleet of 3D printers and connect them to a company’s existing production software. They typically aid in the entire order-to-fabrication workflow. This means order quoting and tracking, print file preparation, print job monitoring and data collection, printer fleet queuing, quality control, and shipping. Companies like ANSYS have developed software that can anticipate any defects that occur during the printing process and compensate for them. Hexagon is taking this one step further by predicting issues at the microscopic level. R&D: Meanwhile, various stakeholders are accelerating the overall market development for AM. Large OEMs are investing significantly in R&D and building internal centers of excellence, while other large corporations—such as HP, from the traditional printing business—are entering the market. Major governments are setting up R&D funds, including the European Union’s Horizon 2020 program, or are starting capability-building programs for their workforces, as in Korea. Universities are partnering with manufacturers’ research centers to create innovation centers for applied R&D, with examples including Advanced Remanufacturing and Technology Centre in Singapore and RWTH Aachen University/Fraunhofer Institute for Production Technology. Although an increased rate of advancement is seen throughout the AM ecosystem, the market for printer segment to hold the largest market share during the forecast period.

11. Conclusion

Additive manufacturing technology, often referred to as 3D printing, has gained significant attention in recent years due to its potential to revolutionize manufacturing processes. However, it is no secret that the initial investment required for implementing additive manufacturing can be substantial. Companies must allocate resources for specialized equipment, materials, and skilled personnel. Yet, there is a silver lining: economies of scale. As companies ramp up production and streamline their additive manufacturing workflows, the per-unit cost tends to decrease. This reduction in cost becomes more pronounced over time, especially when compared to traditional manufacturing methods. According to Airbus, the widespread adoption of additive manufacturing is inevitable, as the next generation of designers will grow up in a new technological reality where AM will be a natural part of the design thought process. In the long run, the financial benefits of additive manufacturing become evident. While the upfront expenses may seem daunting, the ability to create complex geometries, reduce material waste, and customize products offers a competitive advantage. Moreover, additive manufacturing allows for rapid prototyping and iterative design, which accelerates product development cycles. As companies optimize their processes and gain experience, the cost-effectiveness of additive manufacturing becomes increasingly apparent. Thus, the journey from “expensive” to “economically feasible” is paved with innovation in different fields such as Information technology, Robotics and Material Science, and a strategic vision for the future of manufacturing.

References

- Satair: https://www.satair.com/blog/knowledge-hub/five-challenges-of-additive-manufacturing-in-the-aviation-industry

- Dassault Systems: https://www.3ds.com/make/solutions/blog/top-challenges-additive-manufacturing-and-how-overcome-them

- Wohlers Associates: https://wohlersassociates.com/uncategorized/challenges-and-future-trends-in-additive-manufacturing/

- Deloitte:https://www2.deloitte.com/content/dam/Deloitte/de/Documents/operations/Deloitte_Challenges_of_Additive_Manufacturing.pdf

- Wikipedia: https://en.wikipedia.org/wiki/3D_printing

- 3 D REALIZE: [Complete Guide] Fused Deposition Modeling - FDM 3D Printing Method — 3DRealize

- Proto 3000: How Does Fused Deposition Modeling Work? - Proto3000 https://www.youtube.com/watch?v=RgECxaxUIb0

- All3DP.pro: https://all3dp.com/1/design-for-additive-manufacturing-dfam-simply-explained/

- POSTPROCESS: https://www.postprocess.com/video/

- Xometry: 8 Types of 3D Printing and Its Processes | Xometry

- GE Additive: https://www.ge.com/additive/stories/new-manufacturing-milestone-30000-additive-fuel-nozzles

- Airbus : https://www.airbus.com/en/newsroom/news/2016-03-pioneering-bionic-3d-printing

- Airbus : https://www.airbus.com/en/newsroom/news/2021-02-the-new-digital-factory-hundreds-of-kilometres-above-earth

- American Urological Association:https://www.auajournals.org/doi/10.1016/j.juro.2018.02.3011

- McKinsey & Company: Additive manufacturing: A long-term game changer for manufacturers | McKinsey

- Markets&Markets: 3D Printing Market Size, Share, Industry Report, Revenue Trends and Growth Drivers (marketsandmarkets.com)

- Precedence Research: https://www.precedenceresearch.com/3d-printing-market#:~:text=The%20global%203D%20printing%20market,forecast%20period%202023%20to%202032.

- Statista: https://www.statista.com/statistics/315386/global-market-for-3d-printers/

- Fortune Business Insights: https://www.fortunebusinessinsights.com/industry-reports/3d-printing-market-101902

- Forbes: https://www.forbes.com/sites/michaelmolitch-hou/2022/04/25/three-areas-holding-back-the-106b-3d-printing-industry/?sh=4b0306a64935

- Deloitte Insights: https://www2.deloitte.com/uk/en/insights/focus/3d-opportunity/3d-printing-digital-thread-in-manufacturing.html

- Data Bridge Market Research: https://www.databridgemarketresearch.com/reports/north-america-europe-and-asia-pacific-additive-manufacturing-market#:~:text=Data%20Bridge%20Market%20Research%20analyses,period%20of%202024%20to%202031.

- 3Dnatives: https://www.3dnatives.com/en/photocentric-innovation-agency-grant-121020225/

- ScienceDirect: https://www.sciencedirect.com/science/article/abs/pii/S2214860414000189?via%3Dihub

- National Institute of Standards and Technology: https://nvlpubs.nist.gov/nistpubs/specialpublications/nist.sp.1176.pdf

- Telenko, Cassandra, and Carolyn Conner Seepersad. 2012. “A Comparison of the Energy Efficiency of Selective Laser Sintering and Injection Molding of Nylon Parts.” Rapid Prototyping Journal 18 (6): 472– 81

- Baumers, Martin. “Economic Aspects of Additive Manufacturing: Benefits, Costs, and Energy Consumption.” 2012. Doctoral Thesis. Loughborough University